As featured on the August cover of AutoSuccess Magazine.

As we continue to navigate the shifting landscape in auto retail, one thing has become crystal clear… the days of cost-cutting have ended. In December, I wrote about how to make wise cuts to your marketing as the market retracted, and that was the right move then. Now, car sales have surpassed pre-COVID levels and marketing budgets are surging as many dealers have realized the bottom is already behind us. Forecasts are pointing to a rapid climb into 2025.

In this article, we turn to Federal Reserve Economic Data (FRED) to understand the state of the car business and expose what big dealer groups and early movers are doing to recapture market share as car sales boom. Absorb this information and adopt even some of these marketing recommendations, and you can be part of the 20% of dealers that will reap 80% of the rewards as market conditions surge over the next 12-18 months. Do nothing, and you stand to not only miss out on opportunity today but also cripple your market share for years to come.

“It’s The Market” — The Go-To Excuse

How many times have you heard “it’s the market” over the last few years?

Whether it’s your sales staff or your marketing vendors, “it’s the market” has become the default answer when you want to know why the heck your leads are flat and sales are down. At Wikimotive, we despise excuse-making and insist on accountability for ourselves, other vendors, and even our dealer partners. Accountability starts with clear and objective information, and vague statements like “it’s the market” don’t cut it.

The truth is that there are very real market forces at play, which absolutely impact consumer interest, vehicle affordability, challenges desking deals, and challenges running a profitable dealership. The trick is understanding the market so you can leverage against it and gain market share, not twist in the wind or ride a tide that comes and goes. The upside here is that the market data exists… You just don’t hear vendors—the people best versed in data—using it because it often doesn’t result in a pretty picture for them. So let’s pull back the curtain!

What Floor Are We On?

The market measure most dealers are casually familiar with is the SAAR (seasonally adjusted annual rate). It’s a gauge of how many vehicles are trending to be sold that year and helps us compare sales volume against other points in history—or does it?

Something the automotive SAAR doesn’t capture is the part that used car sales play in your store’s profitability. The SAAR, after all, only accounts for new vehicle registrations. Often, when market conditions don’t favor new cars, people who come to the store planning to buy new end up leaving with a used vehicle.

Conversely, when used prices surge on scarcity, new car sales rise. There is a push-pull between them, and to understand the car business, we have to look beyond single factors and take in the whole picture. Volume also doesn’t tell us everything, so at Wikimotive, we decided to embark on a study to find out where we’re really at in 2024 compared to times past—especially pre-COVID.

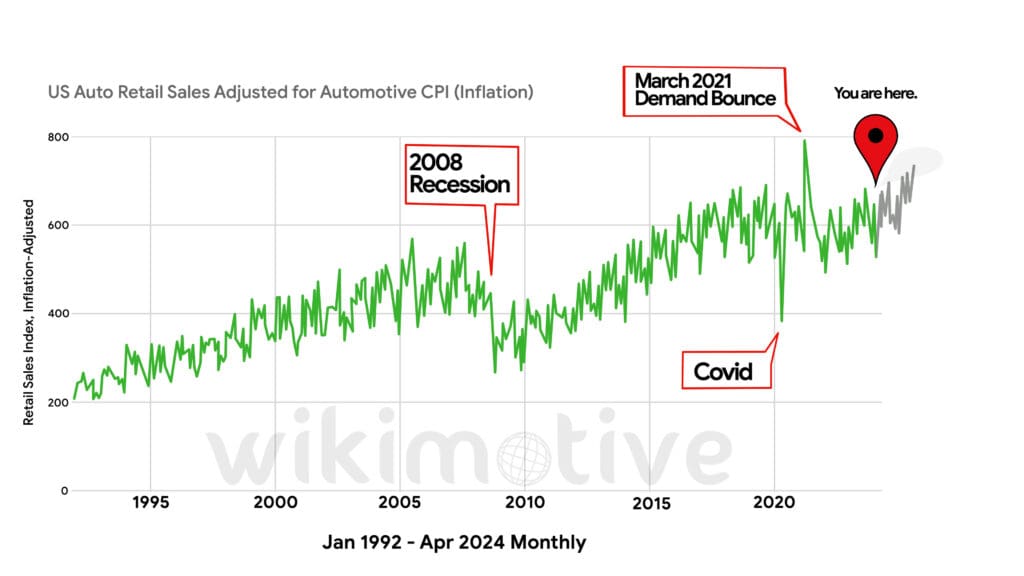

The Wikimotive team and I used the Fed data to tally the total dollar value of new car dealer and used car dealer retail sales nationally since 1992. That gives us a nice clean graph to look at, but it obviously goes up over time because inflation drives up prices! So we also pulled vehicle CPI data (vehicle-price inflation data) to correct for that. The result? A graph showing how the industry as a whole has risen—or fallen—from 1992 to the present, adjusted for automotive inflation. Why 1992? That’s just when all the data points were first available, but it’s really important to zoom out to multiple decades so you can see 2008 and COVID in more context. What does the data show? If you’ve been in the business for the last 30+ years, this should just confirm what you’ve experienced:

- From 1992 to 2007, auto retail grew at a steady, linear pace, increasing by about 90% in 15 years.

- 2008 hit and set the industry back by ten years of growth, cutting total sales by over 30%.

- By 2010, growth was back on track and steeper than ever, with a linear climb through 2019—an almost 80% climb in under ten years.

- COVID hit, and while it has been a rollercoaster, the deepest setback was about 10%—nothing like the size of the 2008 setback.

- By the beginning of 2022, the industry was trending up in a linear way again. It was hard to see it back then, but with the benefit of hindsight, it’s obvious now.

- As of the first half of 2024, the auto industry is pacing 7% higher than the seasonal highest point ever pre-COVID.

Going Up!

Economists forecast 2025 to be a growth year after the continued economic recovery in 2024. Based on the forecasts and the last 30-month trend, we are looking at a 10% year-over-year increase in auto retail sales. That’s a lot of upside on the table, and 10% growth sounds pretty good, but the 80/20 rule applies to auto dealers here…

The rule tells us that the most aggressive 20% of the dealers will experience 80% of the increase. I did the math for you, and the dealers making big moves will collectively average a 40% increase in their business over the next 12 months (the exact math is 44%, but we’re rounding to be conservative here). Let that sink in… What will 40% more sales look like at your store? Will you reach your goals? You will most likely eclipse them!

On the other hand, the 80% of dealers doing the same thing they’ve been doing will share just 20% of that market increase between them. That equates to an average growth of just 2.5% for most dealers over the next year. If your goal is to simply run a steady business, there’s nothing wrong with gaining 2.5%, but to be clear, you should expect to see 2.5% growth in sales over the next year just by riding the rising tide. At that point, you might as well cancel all your marketing spend and put that $20k, $40k, maybe $60k per month in the S&P 500 because it, for reference, has a 30-year average return of 10% per year. I’m not a financial advisor, but this is pretty easy napkin math based on this data.

Okay, let’s summarize… Over the next 12 months, the stats suggest that:

- The most aggressive group of dealers will grow by 40%.

- The S&P 500 [reference point] will grow by 10%.

- The majority of dealers will grow by 2.5%.

“A”! I’ll take “A” please!

The market is on the rise, and we’re already trending at an all-time high. If you’re not feeling that right now, it’s probably because stores and groups looking at the market movements have already ramped up their tactics and budgets to compete harder. The good news is that whether you’re ahead or behind, there’s a surge coming, and there’s time to make intelligent moves that will capture durable market share.

The other good news is that, in times of big marketing spending, the majority of dealers stop looking carefully at how that spend is performing, and they waste a lot of it. This creates an especially large opportunity for dealers who are ready to be aggressive and are able to do it efficiently or are partnered with vendors who value performance and accountability. So, what should you be doing to capitalize on the next 12-18 months of growth?

Hold the Door!

I’ve written whole articles on marketing dos and don’ts based on over 15 years in automotive marketing and Wikimotive’s success stories with scores of dealer partners. We’ll keep the action items simple for this article, but I offer free, no-obligation marketing consultations to Dealers, GMs, and C and D professionals at any dealership. This advice will serve as a starting point, and if you want to learn more, feel free to reach out for a consultation specific to your store.

Start by reallocating wasteful spend. There are a few broad things you can look at without needing any data-analysis chops:

- Measure your third parties using just your CRM to give them credit. They don’t drive enough direct website traffic to get significant credit for anything other than the leads they send straight to your CRM, so it’s a waste of time considering that. Just look at what you spend and divide it by your monthly sales from that third party’s CRM leads. For example, if you spend $5,000 with XYZ third party, have 72 CRM leads from them, and three sales from those leads, that’s a cost per sale of $1,667. If the result is north of $600, cut that third party because there are more efficient ways to use that $5,000. $400 per sale is the goal.

- Ask your paid search (SEM/PPC/VLA) vendor two questions:

a. “Do you do any Display for me?” If the answer is yes, tell them to cut that immediately. No further questions are needed.

b. “Do you have my store name “negatived” out of my paid search account completely?” If the answer is no, tell them to “negative” your store name immediately. They will push back to protect their own metrics, but what will happen is that traffic will stop coming in through paid search and will be recaptured by organic search. When people search your store name, they know they’re looking for your site. Most dealers save about $1000/mo on the Display cut and $1000-3000 by “negative-ing” their store name. That’s money you can, again, reallocate.

The above adjustments are table stakes. These are the basics to tighten up your marketing and trim waste, and there’s a lot more to find with an analytical eye (see: free consultation!). The next thing the aggressive 20% are doing is reinvesting those savings—and then some—in marketing that actually produces market share gains.

To the Top!

Let’s unpack where to add budget to your marketing. The first thing to review is what your SEO is doing—that’s the marketing that should be making you show up organically for Google searches that drive sales. Measuring SEO is more nuanced if you don’t have a lot of background knowledge, and Wikimotive offers two free resources to help with this.

The first resource is an hour-long masterclass video on how automotive SEO works. It debunks vendor BS about SEO and will arm you with great questions to ask. For this, you can just live chat on Wikimotive’s website, and we’ll send you the link. You don’t even have to give us your name if you don’t want to. Second is the free consultation I mentioned above. Specifically, we work up a ranking heat map that shows where you rank organically in your market and where you don’t. Most dealers are failing to rank on Google just five miles from their store and don’t even realize it.

If your SEO isn’t in really great shape, that’s the first place to spend. There are four reasons for this:

- Google searchers who are looking for a dealership or a car are the highest quality traffic you can capture to your website. They convert into leads the most.

- 10x more consumers click on the top organic (SEO) position than click on any single paid search (SEM) position. You can simply capture more through SEO once you’re there.

- Good SEO is labor-intensive and nuanced. That means fewer competitors have the knowledge or wherewithal to compete effectively.

- SEO takes time. Results take at least three months, so if you wait, you’ll miss the surge and fail to capture market share.

With your SEO strategy sorted, the next thing to pursue is efficient paid search and social ads. Just like SEO, paid search and social media solutions are not equal. The most efficient type of each is inventory-specific, driving traffic directly to VDPs. In paid search, that’s Vehicle Ads (aka Vehicle Listing Ads, or most commonly “VLAs”), and on social, that’s carousel inventory ads. Both drive traffic efficiently, and each reaches a different audience.

VLAs capture people who are in the process of searching for a car, while social inventory ads (typically Facebook/Meta) capture people who are thinking about a car purchase but not actively pursuing it right now. There are a lot more nuances to unpack with social ads, especially paid search, but we’ll save that for another article.

Knowledge Is Power

The market data is clear.

We’re in the middle of a market high that’s expected to continue in force through 2025. For dealers who are paying attention and planning ahead, it is not pie in the sky to pursue a sales increase of 40% or more over the next year. All that’s left is to expose your blind spots, illuminate your upside, and take action before you lose out to a more proactive competitor.

Car sales are a zero-sum game. There is only so much consumer demand at one time, and you’re either capturing more of it or someone else is. Reach out to us via Wikimotive’s website. We’re here to help with free resources and our one-of-a-kind free marketing consultation.

The elevator is going up, and we’ll show you what floor you’re on and which elevators go to the top—even if it’s not ours!